Proper financial planning takes into account the whole picture and not just a piece. Part of a financial plan is looking at risk capacity. Wisely created and finely executed financial plan helps to achieve financial goals and keeps your future financially secured.

The risk factors that influence your financial plan can be broadly classified into two major categories as the controllable, personal factors and the uncontrollable, external factors.

Personal Factors Influencing Your Financial Plan

Lifestyle

The house you live in, the car you own, the vacations you take every year and your ability to guilt-spend in a greater capacity – all these are indicators of your standard of living. Your lifestyle is a major factor which decides the path your investments are going to take in the future. As said, higher the standard of living, greater would be the investments.

Learn More: 5 Crucial Characteristics of Risk Management

Appetite for risk

Many a times, windfall gains are a direct result of higher risks taken. However, there is a downside to this – you can lose everything you own too. Each person has their own appetite for taking risks. Some are naturally more comfortable taking risks than others. The other category of people who like to take either no risk or measured risk are termed as being risk averse. Your financial plan will shape up in line with your capacity to take risks. It goes without saying that your returns are directly related to your risk appetite.

Time

Time has a direct relation with one’s financial goals and also is important factor while choosing the investment products. The golden rule is to start investing as early as possible. If you are asking the question today – when should I start investment? Then the answer is yesterday.

Know More : This One Timeline Will Make You Successful at Anything

The simple idea behind starting investment early is that it gives you the benefit of time being on your side. Early in financial planning one is able to choose investing in high risk, high return products since they can afford to take more risk and in case of losses rebuild or repair their portfolio over a period of time.

Level of Income

If you are an entrepreneur, you know how the level of income can change rapidly. The risks involved for someone taking a salary is far higher of losing his/her job leaving them with no income. Financial planning can benefit people at all income levels. Whatever is the level of income, your financial plan should cover for savings and investments; planning for retirement, education, emergencies, major purchases, and other financial goals; and insurance needs.

Also Read: Why Warren Buffett Is Better at Investing Than You?

Influence of Knowledge

If you have a good grasp of your own finances and how they work for you, you are one happy individual. Financial planning gives you an edge over others by providing a better understanding of financial concepts and helping you to achieve proper control over your investments. Once you know where you’re headed and how long it will take to get there, then you can look at your financial plan to find out if you’re spending more money than you’re making.

External Factors Influencing Your Financial Plan

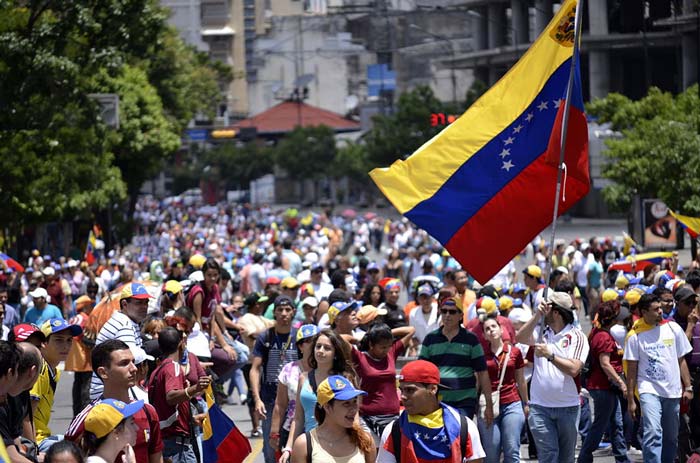

Socio-Economic Circumstances

These circumstances include economic cycles of a country, political and global issues. If a country is doing well, businesses grow well and investments pay good returns. If a country is facing a down slide, investments can get stuck in the rut. Similarly, political stability of a country also decides the prosperity of an economy. It has significant impact on the performance of investments.

Global issues like increase in the price of oil or even some other country going down economically, impact the investments. As a result, the graph of the global economy is also an important indicator of our growth.

Interest rates

The rates at which individuals and businesses borrow and lend to the banking sector and other lending institutions are determined by the interest rates in the economy. Usually, when people want to borrow more money to grow their businesses, interest rates in the market increase.

Read More : Why Entrepreneurs should take risks every day?

Inflation

Expected rate of inflation has a direct impact on financial planning. If the inflation rate is high, one needs to look at an investment product which gives higher returns. For example, if the inflation rate is 4%, then an investor should look at an investment product which gives at least 14% returns so that the real returns is 10% (14% – 4%) in hand of the investors.

Disruption

In the age of digital revolution, we are innovating like never before. Disruption now become a part of the ecosystem we live in. Some innovations can create a new market and value network and eventually disrupts an existing market and value network, displacing established market leading firms, products, and alliances.

Learn : How Robots in Business Will Create New Opportunities?

Disruptive innovations tend to be produced by outsiders and entrepreneurs, rather than existing market-leading companies. Disruption can also be considered to disrupt beyond businesses and economies.

With the risks and uncertainty in market conditions, Financial Planning is absolutely essential to create a steady portfolio and generate adequate returns. Through proper financial planning you can save and as a result, earn enough. This will help to plan your financial needs, such as starting a new business, your dream vacation or better a new home.

Do you know any other risk factors that influence a financial plan? Comment them on Trdinoo for others to learn. Please subscribe and share us with your friends and networks.